When it comes to purchasing a residential lot, the reasons for building a house can be numerous, from living in it, establishing an estate, or earning extra money through your rent.

Many people choose to invest in more than one home, specifically building a vacation home to enjoy vacation periods and get out of the routine, but also to take advantage of and rent it when it is not planned to live in it.

The demand for vacation homes in Pakistan is increasing, and this trend is expected to continue, so it is the perfect time to invest in a property, such as Park view lahore , for this purpose.

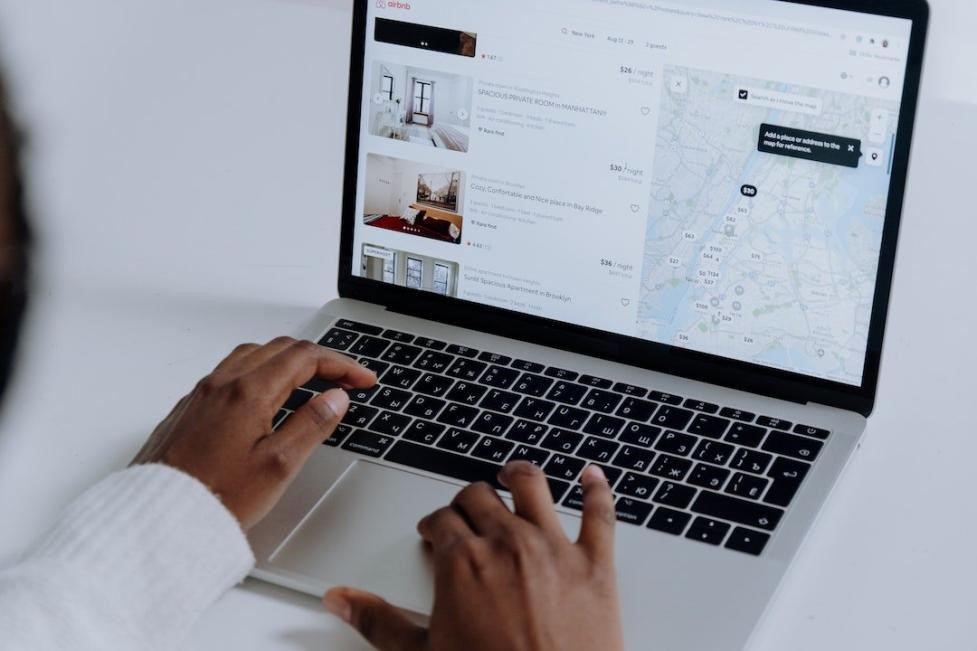

This type of investment has existed for more than 45 years and is present almost everywhere in the world, being a success, and even more so now, thanks to media such as Airbnb and Vrbo.

In this article, we will mention how you can take advantage of your investment to acquire residential land and build a vacation home that generates constant income.

What are Vacation Homes?

To begin with, we must define what a vacation home is: as its name indicates, it is a property designed to enjoy your own space while you are traveling.

Vacation homes offer you all the comforts of home; in addition to having the independence that a hotel and other similar types of accommodation do not offer, they are an excellent option to rest in a more private environment and with greater freedoms.

You can find vacation home rentals in oceanfront locations with access to private beaches and even in luxury apartments in the middle of the city.

In this type of property, they have amenities such as a swimming pool, balcony or terrace, gardens, parking, and even —if you are in a luxury residence— services such as a spa, massages, yoga, parks and many more.

Advantages of Building a Vacation Home

Investing in a property is one of the safest investments you can make, whether you are going to live in it or not, especially if the location of your choice is in an area where capital gains are constantly increasing.

Among the main advantages of investing in a vacation home are:

1. Double Benefit: Vacation and Produce an Income

Building a property of this type results in great benefits because you will have at your disposal a house or apartment to vacation with your family, partner or friends in your favorite place and, above all, you will be able to rent it the rest of the year producing an income.

An advantage of buying a property is that it is a tangible asset, so inflation does not affect it as much as money.

2. The Demand for Vacation Homes is on the Rise

The sum in 2019 for investments in vacation rentals was estimated at 170 million dollars according to Research and Markets, and —according to Market Insights Reports— a 5.8% growth in the vacation rental market is forecast during the forecast period of 2022-2028.

This is because vacation homes offer a different type of accommodation than hotels. In addition, its popularity has been increasing thanks to platforms such as Airbnb and Vrbo, so the investment to acquire real estate for this purpose is increasing.

3. Produces a Consistent Return on Investment

Profitability can be defined as the profit obtained from an investment. To do this, you must consider factors such as maintenance costs and payments for services and taxes.

Investing in real estate is safe since it can maintain or increase its value over the years, depending on several factors such as location, which has a direct impact on the capital gain of the property.

The value of your rent will go hand in hand with the value of your property; therefore, you must make sure that it has been manufactured with quality materials to avoid extra maintenance costs.

Similarly, the amenities and services with which it will be offered for rent play an important role when setting rates.

It is worth mentioning that this return on investment will be safer if it is acquired in areas near important tourist spots.

How to Make Money Renting Vacation Homes

1. Use Platforms like Airbnb or Vrbo

Hotels have been able to maintain their levels of visits, but —currently— young people opt for simpler options that provide them with greater freedom and privacy.

The popularity of these applications is evident thanks to technological advances, and it is becoming more and more common to think of renting a vacation home for a weekend or longer, thanks to the facilities found in this medium.

Whether the trips are made for pleasure or for work and business reasons, these applications have managed to position themselves among the favorites when looking for accommodation.

What is this about?

Travelers see vacation rentals as an opportunity to make their stay more interesting and a unique experience.

For example, when making a business trip, being able to stay in a luxury apartment with amenities such as a gym, spa, and swimming pool, among others, is more attractive than a conventional hotel room.

Likewise, spending a family stay in a house facing the sea, with all the comforts and services they may need, promises a more peaceful and relaxed trip.

In addition to the above, these types of services are reliable and safe. Furthermore, some of the aspects that make these platforms different are:

- You will be part of a global travel community of more than 190 countries

- There is a relationship between travelers and hosts

- The customer support team is available 24/7 and in multiple languages

- Payment protection in case of fraud

- Emergency Assistance

Thanks to this, it is that investing in a property of this type results in great benefits; you enjoy your own space in an exceptional place with all the amenities when you need to vacation, and the rest of the time you put it up for rent through platforms like Airbnb and Vrbo to ensure a passive income.

2. Rent through Social Networks

If you want to take charge of the entire process of personally offering and handing over the house to tenants, then using social networks is a good option since you will maintain direct contact during the process.

Platforms like Facebook Marketplace are perfect for offering a vacation home for rent, especially if you want to keep it local.

3. Adapt an Area for Commercial Premises

A different way of making money with a vacation home is to adapt some of its areas for another purpose, such as commercial premises.

If you have a large enough space, or the location of the property is particularly advantageous, then you can resort to making the modifications with the help of an architect to separate the living area from the premises.

4. Offer Only the Rent of a Room

Even if you plan to live in residence, an idea to generate extra income is to offer a free room for rent, in case there are several rooms. This works perfectly for students, professionals, and even foreigners on vacation.

This option is perfect for taking advantage of that extra space without having to vacate the house and still continue with a constant income.

5. Rent out the Garden or Garage

If your vacation home is located in a busy city with constant traffic, one way to generate extra income is to offer the garage for rent. In places where finding parking space is so difficult, this option is a good way to generate income.

On the other hand, not all homes have spaces such as gardens or terraces. If this is the case for your vacation home, then you can take advantage of it to rent it.

How to Generate More Income with the Same Space?

The same space for rent can generate better income if it is conditioned with this purpose in mind.

If you plan that your vacation home will also be rented, it is important to consider some factors that mean that the same house can be offered at higher costs.

To begin with, the decoration always plays an important role, since one of the first approaches that the possible client has is photographs. Similarly, make sure you have all the basic services, such as electricity and water, but also benefits such as wifi, air conditioning, etc. The higher the benefits, the better the rate and demand.

On the other hand, if you plan to build a vacation home, then you can plan its details not only to your preference but also to the possibilities offered by putting it up for rent.

And if you want to wait before building your vacation home, there is also the option of renting the land, always trying to make the lease contract to protect your assets.

Factors to Consider Before Buying to Rent

If you want to invest in a vacation home to rent later, it is important that you take into account the following factors before buying:

1. Accessibility and Connectivity

A property that is accessible and close to avenues that connect with important points in the city is a key factor for decision making.

For example, in a cosmopolitan city, acquiring a residential lot on the main avenue offers better rental opportunities for any type of home that you want to develop in the future, given the facilities it offers to reach areas of tourist interest, like the beach or Fifth Avenue.

2. Growth Projection

Another factor that you should consider when making an investment since it has an impact on the value of the property over the years as well as on the income that can be obtained.

3. Area Security

Many nationals and foreigners seek the peace of mind of being located in a safe area; therefore, it is an essential point to consider before purchasing. Due to factors like this, many investors are constantly betting on the Mexican southeast.

4. Amenities

They are attractive —especially— when it comes to looking for a place to relax and enjoy a quiet vacation, so they influence the purchase decision in the same way.

Location is a factor that greatly influences the value of a property. You must be sure that the area has all the services with constant growth projections.

A property located near services such as hospitals, first-class schools, shopping malls, restaurants, and entertainment centers, among others, guarantees an increase in capital gains and your investment.

Make your Money Grow by Investing in a Vacation Home

Undoubtedly, real estate investment is safe. It guarantees that your money will grow and it is an excellent business option.

The facilities provided by the platforms for renting vacation homes allow you to start receiving income almost immediately.

At Sky Marketing, we have more than 25 years of experience, bringing investors closer to the most promising projects in Pakistan with a guaranteed return on investment.

If you have investment plans in Pakistan, contact us and one of our real estate experts will advise you according to your objectives and investment plans.

To learn more about how to invest and earn money, we recommend you review our real estate blog, where you will find articles such as rate of return: How is it calculated in real estate? Is it better to buy land or a house for retirement?

Author: M. Rubayet